Table of Contents:

Technology is continuously reshaping the fabric of our financial systems, and blockchain is at the helm of this revolution. In this article, we are going to explore the concept of blockchain in banking and find out if it's indeed the next big revolution. This piece is carefully crafted for beginners in the financial and crypto domain, ensuring accessibility and comprehension.

Introduction: The Next Big Revolution?

The dawn of financial technology brought with it a plethora of exciting prospects. Today, blockchain, the technology underpinning cryptocurrencies like Bitcoin, is poised to disrupt traditional banking systems, promising transparency, security, and speed of transactions.

The Best Mining Providers at a Glance

» Infinity HashFrom our perspective, currently the best mining provider on the market. With the community concept, you participate in a mining pool completely managed by professionals. A portion of the earnings are used for expansion and maintenance. We've never seen this solved as cleanly anywhere else.

» Hashing24A well-known and established cloud hosting company. With a good entry point and in a good market phase, a good ROI can also be generated with some patience. Unfortunately, we see the durations as a major drawback.

Understanding Blockchain

Simply put, a blockchain is a decentralized, digital ledger that records every transaction across a network of computers. It is immutable, transparent, and eliminates the need for intermediaries, which makes it a potential game-changer for industries far and wide, especially the banking sector.

Advantages and Disadvantages of Blockchain in Banking

| Pros | Cons |

|---|---|

| Greater Transparency | Regulatory and Compliance Concerns |

| Increased Efficiency | High Initial Costs |

| Improved Security | Scalability Issues |

| Reduced Costs | Data Privacy Concerns |

| Financial Inclusion | Lack of Clear Government and Industry Standards |

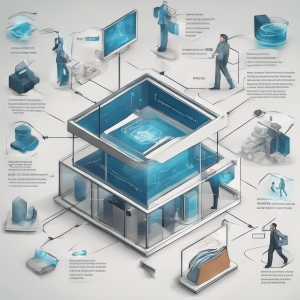

How Blockchain Works in Banking

Blockchain shines in its ability to simplify complex processes. It can remove the need for intermediaries, helping to reduce overheads and increase efficiency. For instance, in cross-border payments, blockchain can significantly speed up and reduce the cost of transactions by automating the entire process with its smart contract functionality.

Potential Advantages of Blockchain in Banking

Blockchains can potentially bring about a drastic change in banking. These advantages include reduced costs due to the removal of middlemen, faster transactions as blockchain operates round the clock, enhanced security due to its immutable nature, and the possibility of financial inclusion for unbanked individuals around the world.

The Challenges Ahead

While blockchain does offer various advantages, the road to full-scale adoption is not without challenges. These include regulatory hurdles, network management issues, dealing with the energy consumption of blockchain operations, and convincing individuals and businesses to trust and understand this new technology.

Conclusion: Is It Really the Next Big Revolution?

Blockchain in banking truly could be the next big revolution. As with any emerging technology, there will be hurdles to overcome. However, the advantages that blockchain offers like transparency, speed, and cost-effectiveness potentially tip the scales in its favor. It's a technology that's still in its evolutionary stages, and what the future holds, only time will tell.

Understanding Blockchain in Banking: A Transforming Revolution

What is blockchain technology in banking?

Blockchain technology in banking is a distributed ledger that securely records all transactions across a decentralized network. This technology provides an immutable and transparent way to record transactions, enhancing the speed, security and efficiency of banking operations.

How can blockchain transform the banking sector?

Blockchain can transform the banking sector by streamlining payments, improving KYC processes, preventing fraud, reducing operational costs through smart contracts, and providing transparent and unified customer experiences.

What are the benefits of blockchain in banking?

The main benefits of blockchain in banking include enhanced security, increased transparency, improved efficiency, cost reduction, and the possibility of implementing programmable money and digital assets.

What are some examples of blockchain used in banking?

Examples of blockchain used in banking include Ripple for cross-border payments, Ethereum for smart contracts, and various major banks exploring their own blockchain solutions for a variety of use cases.

Why is there so much hype around blockchain in banking?

There is so much hype around blockchain in banking due to its potential to revolutionize how transactions are conducted and recorded, enhance security, reduce costs and remove third party or middlemen from the banking processes.